tax avoidance vs tax evasion examples

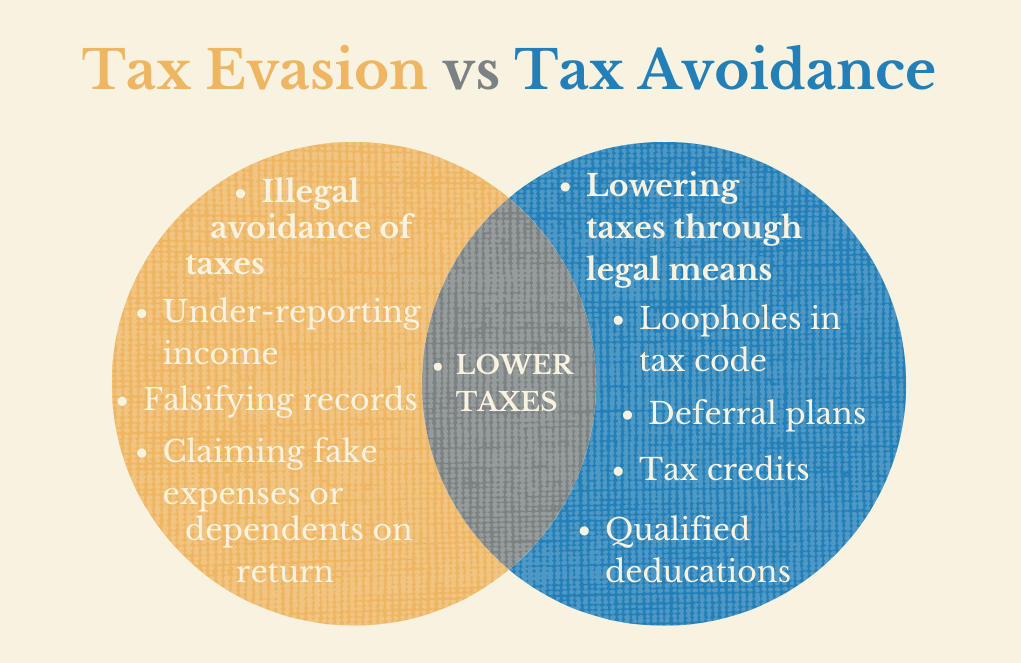

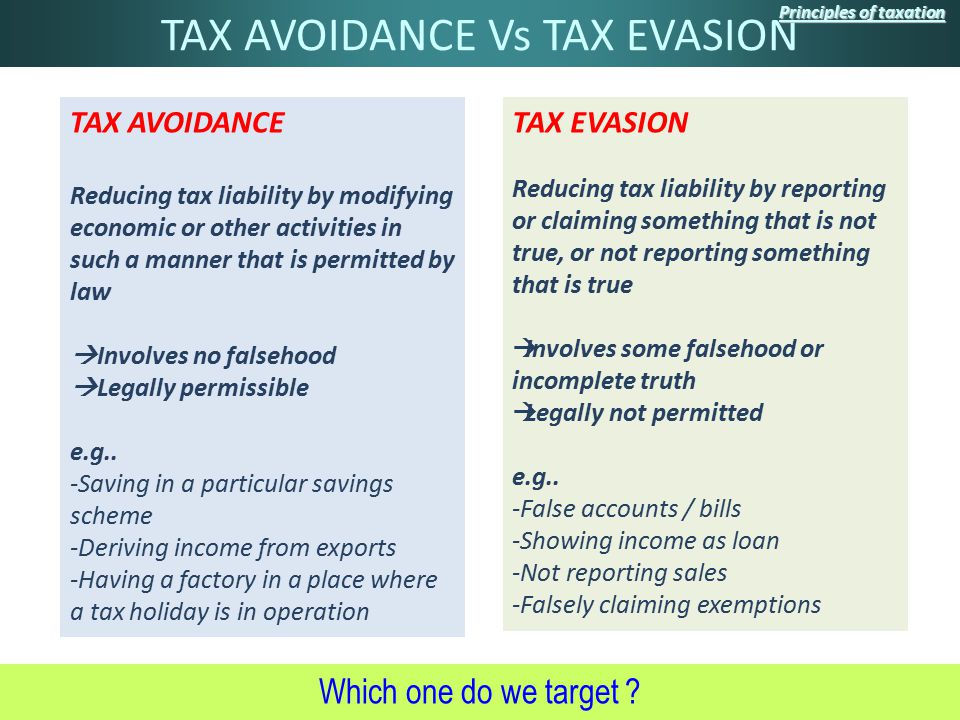

This is a criminal act that when captured will result in prosecution. It is a legal strategy that taxpayers can use to legitimately lower their IRS tax bills.

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax evasion is a federal offense.

. In tax avoidance you structure your affairs to pay the least possible amount of tax due. To start with tax avoidance is legal while tax evasion is illegal. The existence of entities specialized in investigating corruption.

While you get reduced taxes with tax avoidance tax. Tax evasion includes underreporting income not filing tax returns and purposely underpaying taxes. Tax Evasion vs.

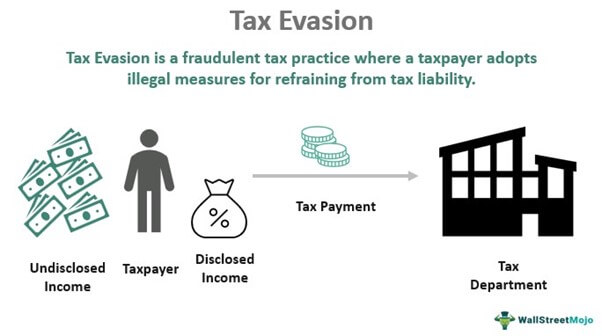

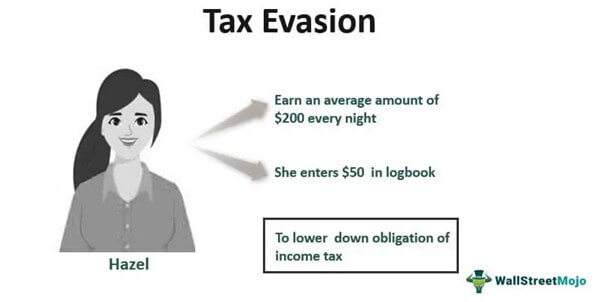

Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments. Depending on where a persons tax evasion crime lands in the set categories they may face a prison sentence of anywhere from one to five years. Underground economyMoney-making activities that.

To assess your answers click the Check My Answers button at the bottom of the page. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business. Payment of tax is avoided though by complying with the provisions of law but defeating the intention of law.

Let us discuss some of the major differences between Tax Evasion vs Tax Avoidance. The preparation of sound protocolsintervention guides and procedure manuals that may favor communication between the various responsible entities. Tax avoidance is taking advantage of credits and deductions and saving for retirement.

Tax Evasion vs Tax Avoidance. This is one of the most common tax evasion examples. You might do this by claiming tax credits for example or investing in tax-advantaged Individual Retirement Accounts IRAs or 401 k plans.

When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax Avoidance and committing criminal tax fraud especially in the realm of international and offshore tax aka Tax Evasion. Evasion is the prohibited control of organisation affairs to leave tax. It is undertaken by taking advantage of loop holes in law.

The Taxpayers Responsibilities Key Terms tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Select Popular Legal Forms Packages of Any Category. Tax evasionThe failure to pay or a deliberate underpayment of taxes.

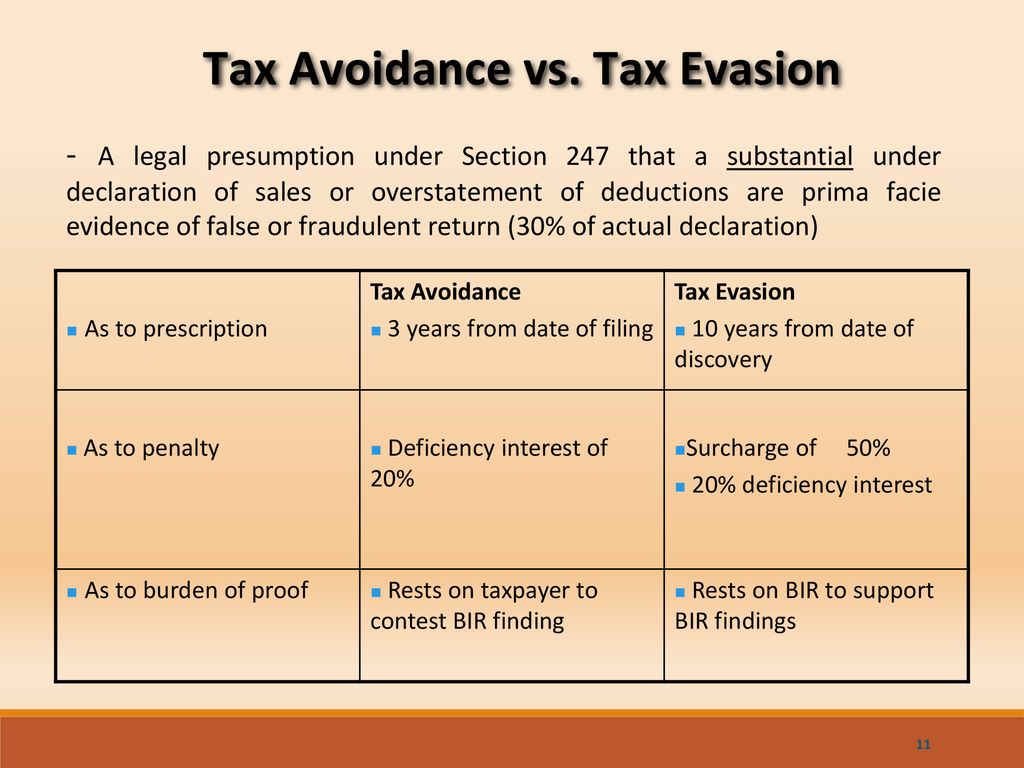

The Government of any country offers areas and multiple options to the public and entities. There are prison sentences and hefty fines. Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object and spirit of the law.

Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1. An example of tax avoidance is a situation where a person owns a business and employs his or her spouse. Tax evasion can lead to a federal charge fines or jail time.

On 16 Feb 2022. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer. Moreover one of the common examples of tax avoidance to minimize a taxable income is when a homeowner receives a tax deduction from their home mortgage although tax rules have drastically changed over the years.

Youve seen the examples of tax evasion and tax avoidance above. This includes not paying taxes you owe even though. Payment of tax is avoided through illegal means or fraud.

We have gathered examples from recent and historic high-profile cases to help you unpick the fine line. Which are the causes of tax evasion. Most commonly tax avoidance is done through claiming as many deductions and credits as possible.

Are you unsure of the difference between tax avoidance vs. Tax avoidance is defined as taking legal steps to reduce your tax bill whether thats taxable income or tax owed. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts.

In tax evasion you hide or lie about your income and assets altogether. Person determines whether the tax planning activities they are. All Major Categories Covered.

In addition providing tax deductions for. Is tax avoidance legal or illegal. Tax avoidance refers to an attempt to reduce tax payments by legal means for instance by exploiting tax-loopholes whereas tax evasion refers to an illegal reduction of tax payments for instance by underreporting income or by stating higher deduction-rates1 Tax flight refers to the relocation of businesses only in order to save taxes for.

The difference between tax evasion and tax avoidance largely boils down to two elements. Tax avoidance is structuring your affairs so that you pay the least amount of tax due. It is undertaken by employing unfair means.

The difference between tax avoidance and tax evasion essentially comes down to legality. An example could be the directors of family-owned service not declaring cash sales. If you or a loved one has been accused of tax evasion.

The following are the contrast in between tax avoidance and evasion. Avoiding tax is legal but it is easy for the former to become the latter. Fines for tax evasion range from 100000 per year to a one-time payment of 250000 depending on the crime.

Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law. If income is not reported by someone authorities do not possess a tax claim on them. 1 Keeping a log of business expenses.

Tax Avoidance vs Tax Evasion. Crossing that line can lead to hefty fines and prosecution. Tax Avoidance is legal.

Hence check the details below to get to know about tax evasion vs tax avoidance. Measures improving the ability to. The other one is the evasion of payment.

Tax Avoidance Examples Five examples of tax evasion tax fraud and 4 examples of common tax avoidance strategies. The difference between tax avoidance and tax evasion boils down to the element of concealing. Trust the Attorneys at the Law Offices of Kretzer and Volberding PC.

Having tax software can help you manage stuff like this legally. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to.

Your Role as a Taxpayer Lesson 3. Promoting the work of multidisciplinary and highly specialized teams. Tax evasion is often confused with tax avoidance.

The first one is the evasion of assessment which includes not informing tax authorities of your exact income.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Tax Evasion Vs Tax Avoidance Dsj Cpa

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

How To Reduce Your Tax Legally And Ethically Ppt Download

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Principles Of Taxation Ppt Download

What If A Small Business Does Not Pay Taxes

The Concept Of Tax Evasion And Tax Avoidance Definition And Differences